Wednesday, May 10, 2023

This was a monster trade! $1K profit in 7 minutes! I made some mistakes yesterday but came back today and followed my rules and got the entire move of a Low-Resistance Liquidity Run. For more information, see my article about LRLR.

I am realizing that one of the main reasons for my recent trading success, is just time spent reading price action and looking for my model, the ICT 2022 Mentorship Model. By time I mean the duration of months and years spent in the Futures Markets. I am seeing and including things in my analysis now, that I never would have imagined even months ago. These things have come slowly but just one day you realize that you are incorporating things in your split-second analysis that wasn’t there the day before. And it all comes down to just the amount of time you are spending watching and studying price.

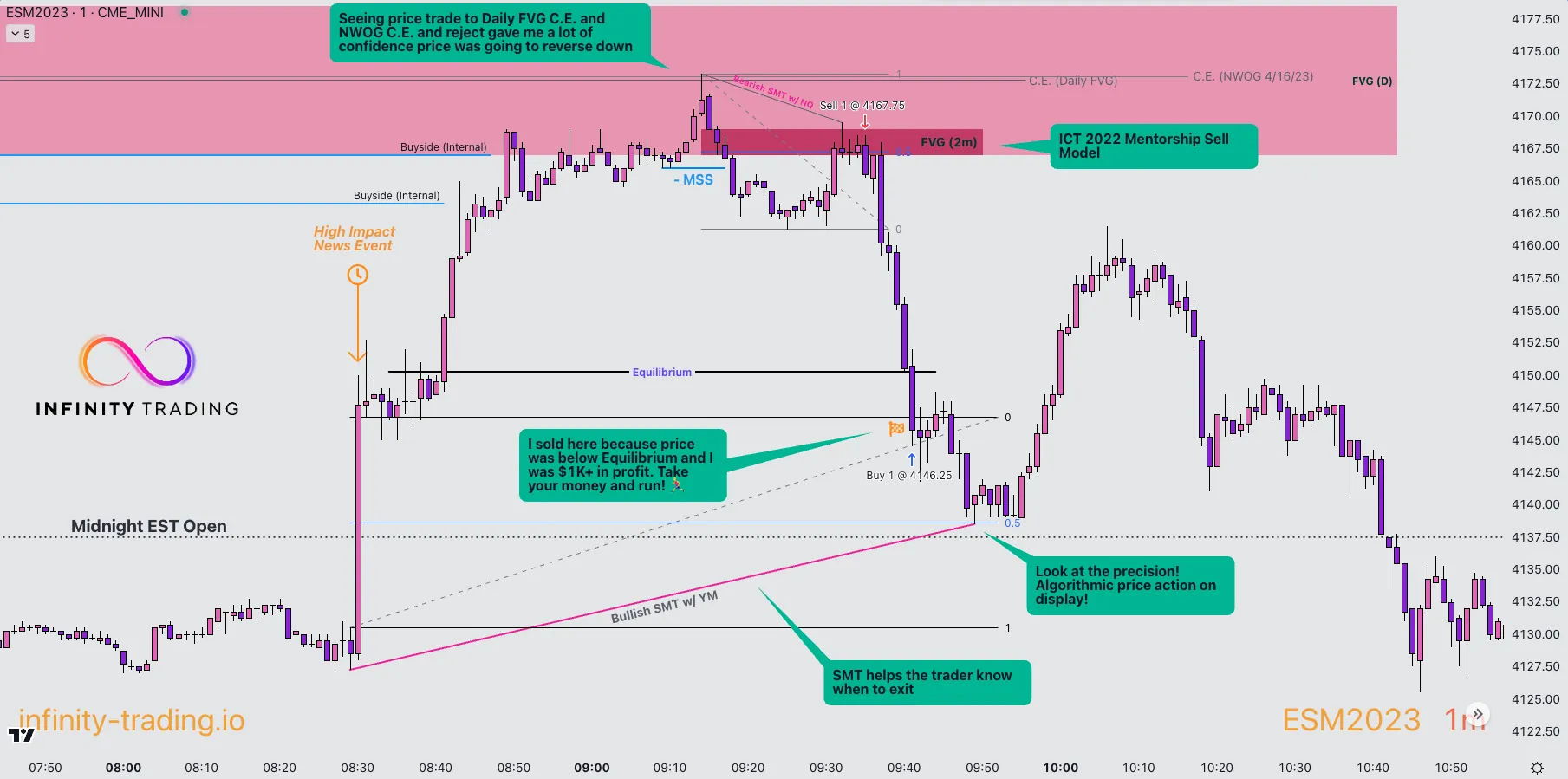

For this trade the first principle key was having the Daily FVG marked on my charts. Everything else flowed from that. At NY Open I realized that ES had wicked up to what appeared to be Consequent Encroachment of the Daily FVG and then retreated. So I drew my Fibonacci and sure enough, the price I had went to it and reversed. Then I noticed that price also bounced off an NWOG from 4/16/2023. And lastly, ES had gone above two Buyside Liquidity pools from previous days. These were three, rock-solid, reasons why the price would reverse after going up earlier from the CPI High Impact News event. Additionally, my current Bias and Narrative had ES going down so this fueled my short trade idea.

I then started looking for the ICT 2022 Mentorship Model and right after NY Open price was inside a 2-minute FVG in a Premium. Even though this was minutes after the opening bell, I was also watching NQ and it had made a higher high while ES had not. This is Bearish SMT Divergence and was the final reason I used before entering short with a Market order.

(NQ was an example of Turtle Soup. See my Turtle Soup entry on my ICT Dictionary article for more information)

Before I knew it price was screaming down. Honestly, it was kind of a blur. I knew the price had gone down below the Equilibrium of the CPI move up, and after seeing my profit cross the $1K mark, I sold to lock in my gains. ES only went down a litter further after I exited.

The lesson of my trade is to not give up! Keep studying and spending time in the markets. Create rules and follow them. Before you know it, you will find success.