Apex Trader Funding

Writing now!

Summary

…

Apex Pros

…

Apex Cons

- Inadequate Web Dashboard & Slow Online System

- Trailing Threshold Uses Max Profit & Not Closed Balance

- Very Strict and Burdensome Payout Rules

Inadequate Web Dashboard & Slow Online System

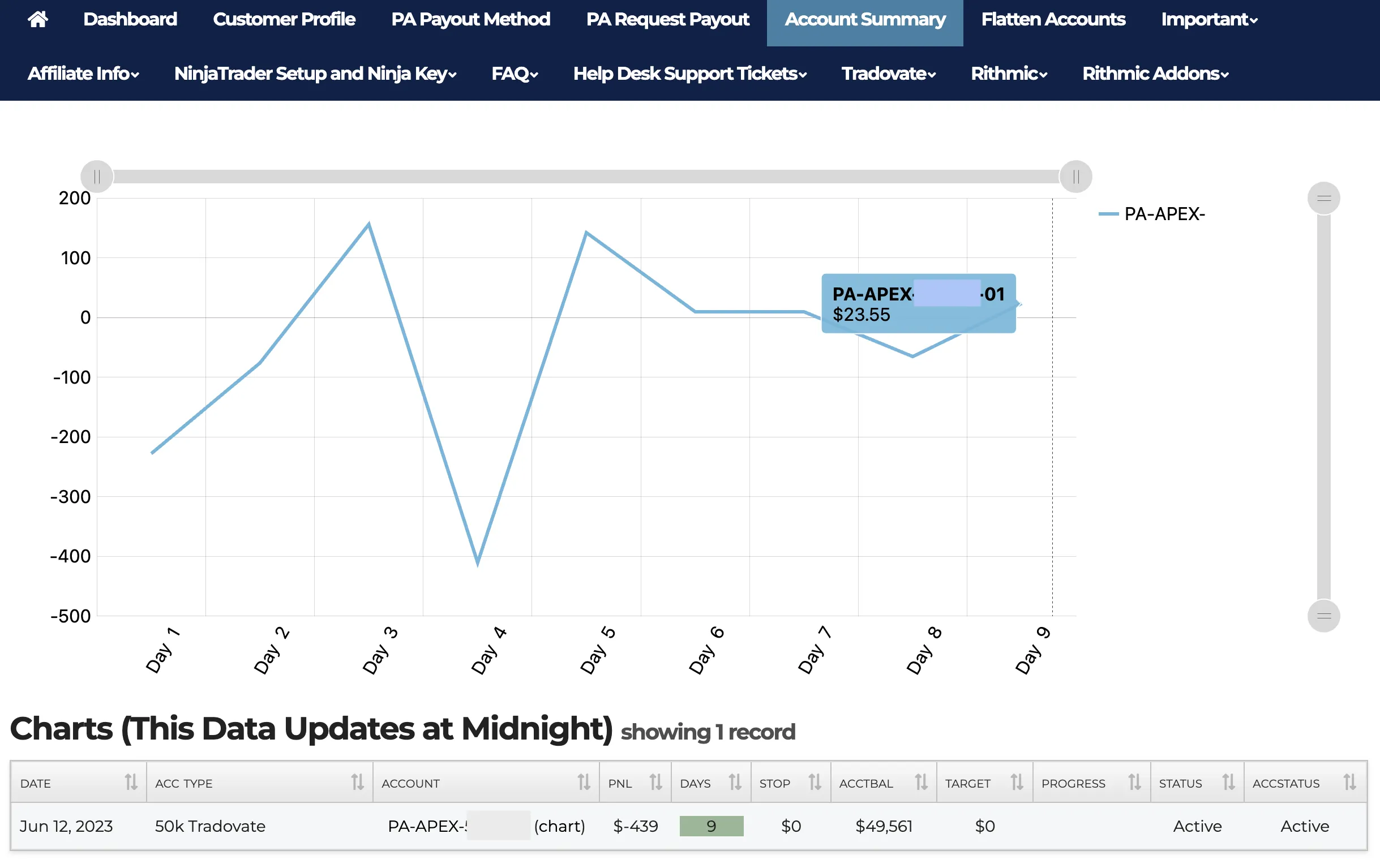

The Apex online Dashboard and system is very rudimentary and clunky. The image below is all the trader gets from Apex: an awkward line chart that isn’t very helpful. There are no other locations on the Apex website to get information or statistics on your trades. Yes, the line chart displays the total amount of money you made per day, but that is it. The x-axis is simply different trading days. It displays no information about which date the proft is corresponding to. And to make it even worse, the chart doesn’t specify how many days are between any two “Day X” values. So there could be three trading days, a week, a month, or move between any two dates on the x-axis. This makes it worthless for analyzing perforance because you cannot remember which profit goes with a Day.

Apex Trader Funding Online Dashboard

The Apex online web portal does not update in realtime. It only updates once per day after the trading days has ended. So there is no mechanism during the trading day to check or track progress. You have to wait to the end of the day to check your trading days or see how much money you have for a potential payout.

Trailing Threshold Uses Max Profit & Not Closed Balance

…

Very Strict and Burdensome Payout Rules

…

Apex Evaluation Account

I chose the Tradovate/NinjaTrader 50K FULL Apex Account. In Apex you pay an ongoing monthly fee for the Evaluation Account as long as you have not failed any of their rules and you have not reached the profit goal. For my 50K Full Evaluation Account, the profit target was $3,000. The starting balance is $50,000 and you pass the Evaluation account when you make $3,000 in profit which means your balance is greater than $53,000.

Apex’s schtick is to list Evaluation Accounts for a monthly fee of $167, $187, $207, etc. but then discount them at 70%, 80%, and even 90% off. For example, at Tradovate $50K Full Evaluation Account at 80% off costs only $37.40 per month. It’s a really good value!

In the Apex Evaluation Account, there are no other charges or hidden fees. You will be charged immediately the monthly fee once you first sign up. And then each subsequent one-month anniversary you will be charged again. That is it! No subscriptions, licenses, or data fees for the Evaluation Accounts.

I like the monthly fee model compared to a much larger one-time lump sum. For me, it feels less daunting for a $50K Evaluation account that costs $40 per month compared to a $300 one-time fee. If something unlucky happened to the Evaluation and I broke any of the rules I would be devastated to have blown $300 compared to $40 or even $80.

On your trades, there are standard commissions. But for CME Futures (ES, NQ, YM, etc.) these are a flat rate commission and are not a big deal.

With Apex you need to take trades on a minimum of 7 trading days. This means that on 7 different trading days, you need to take trades. But the trading days do not need to be sequential. If you don’t want to trade a particular day you don’t have to. Take as long of a break as you would like between trades. This incentives traders to only take high-quality trade setups. But you will be charged the monthly fee every 30 calendar days. If you have not met the Profit Goal and you have traded on at least 7 trading days, then you have met the trading days requirement and you only need to focus on reaching your profit target. This takes a lot of the pressure off.

Apex Drawdown

Coming soon!

Apex Funded Account

Coming soon!

Apex Payout

Coming soon!

Top Step

Coming in the future!

Get 20% OFF

Summary

Top Step Pros

Top Step Cons

Top Step Evaluation Account

Top Step Drawdown

Top Step Funded Account

Top Step Payout

CME Futures vs. CFDs

The Chicago Mercantile Exchange (CME) is an organized exchange for the trading of futures and options. The CME trades futures, and in most cases options, in the sectors of agriculture, energy, stock indices, foreign exchange, interest rates, metals, real estate, and even weather. CME is the only place to trade the official S&P, Nasdaq, & Dow Jones futures contracts that are known by:

- E-mini S&P 500 (symbol

ES) - E-mini Nasdaq-100 (symbol

NQ) - E-mini Russell 2000 Index (symbol

YM)

A Contract For Difference (CFD) and a Futures contract are financial derivatives. They both can be traded on a wide range of financial instruments. A CFD is a contract between a broker and a trader who agree to exchange the difference in value of an underlying security between the beginning and the end of the contract, often less than one day. Futures trading is an agreement to carry out a transaction at some point in the future at a price agreed today.

One important difference between the two is that futures trading is conducted in a centralized open market where all participants can see trades, quotes and rates. Investors have a wider choice of instruments in futures markets, so there are more opportunities to hedge positions in relation to CFD markets. CFD trading, on the other hand, is conducted through a broker, who is the counterparty to the trade. In futures trading, the broker is simply an intermediary. In CFD trading, the broker is the effective counterparty to the transaction and quotes the prices for both of the parties in the trade. This is a disadvantage as compared to futures markets, as the broker who is the intermediary between buyer and seller can manipulate prices on both sides to their benefit.

Infinity's Thoughts

There are several good reasons to trade either CFDs or Futures. They both have their pros and cons. CFDs are great because you easily can scale up or down the number of lots on each individual trade. This means if you wanted a $50 risk on one trade or a $7,000 risk on the next trade, you can easily do that. Futures are great because they have flat-rate commissions but can only choose between mini or micro sizes.

Unfortunately for individuals residing inside the United States, CFDs are illegal States because the trades don’t pass through a regulated exchange. Beyond the illegality there are two reasons I prefer CME Futures over CFDs: spreads and candle differences.

Spreads vs Commissions

As stated in the paragraph above, CFDs are offered by a broker who controls both sides of the transaction. As a way to make money CFD brokers add a second variable spread to the trading commodity that they alone control. This spread allows them to make even more money on every transaction. Since the brokers control both sides, they manipulate these spreads to maximize their financial gain while inflicting purposeful pain on traders. I don’t want to add this stress to my trading. I don’t want to have to worry about how my broker is out to get me: the price algorithm is enough to worry about.

In Futures there is no second spread put on top of price. When price crosses my Limit Order level I don’t have to worry about me not getting filled: I know I will get filled. Of course there are millions of CFD traders that successfully navigate this every day. But for I don’t want to worry about it.

Candle Differences

But the major difference that I don’t want to trade CFDs and want to trade CME Futures is because the candles are actually different! And different in a meaningful way.

By different I mean the same candles in the following tickers: ES & US500, NQ & US100, and YM & US30.

Firstly, the actual price levels between the same time marked candles are at different prices. This is most likely because CFD are a continuous contract while Futures have a time expiration. Regardless, they are straight up different.

Secondly, the actual candles can be completely different compared to each other. Sometimes a CFD will make a higher low while the same candles in the Futures contract actually made a lower low. This is a really big deal!

It is best explained in the chart examples below of the same 1-minute price action between the CFD US100 and the CME Futures contract NQM2023

US100

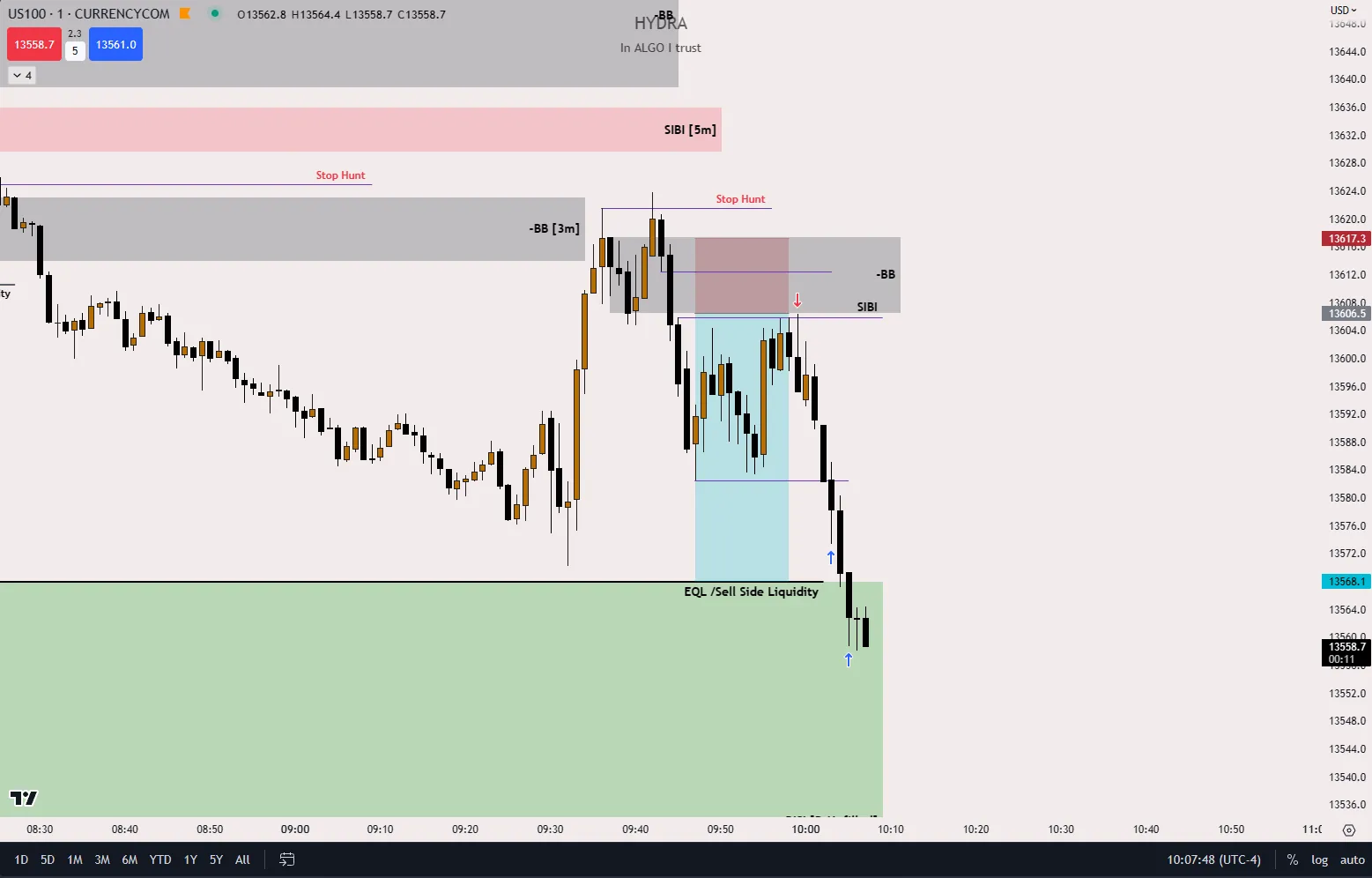

In the image from the Tweet below from Hydra (go follow him now) notice the 1-minute candles of US100 .

Click the image to make it bigger.

Futures US100 Verses NQ

NQ

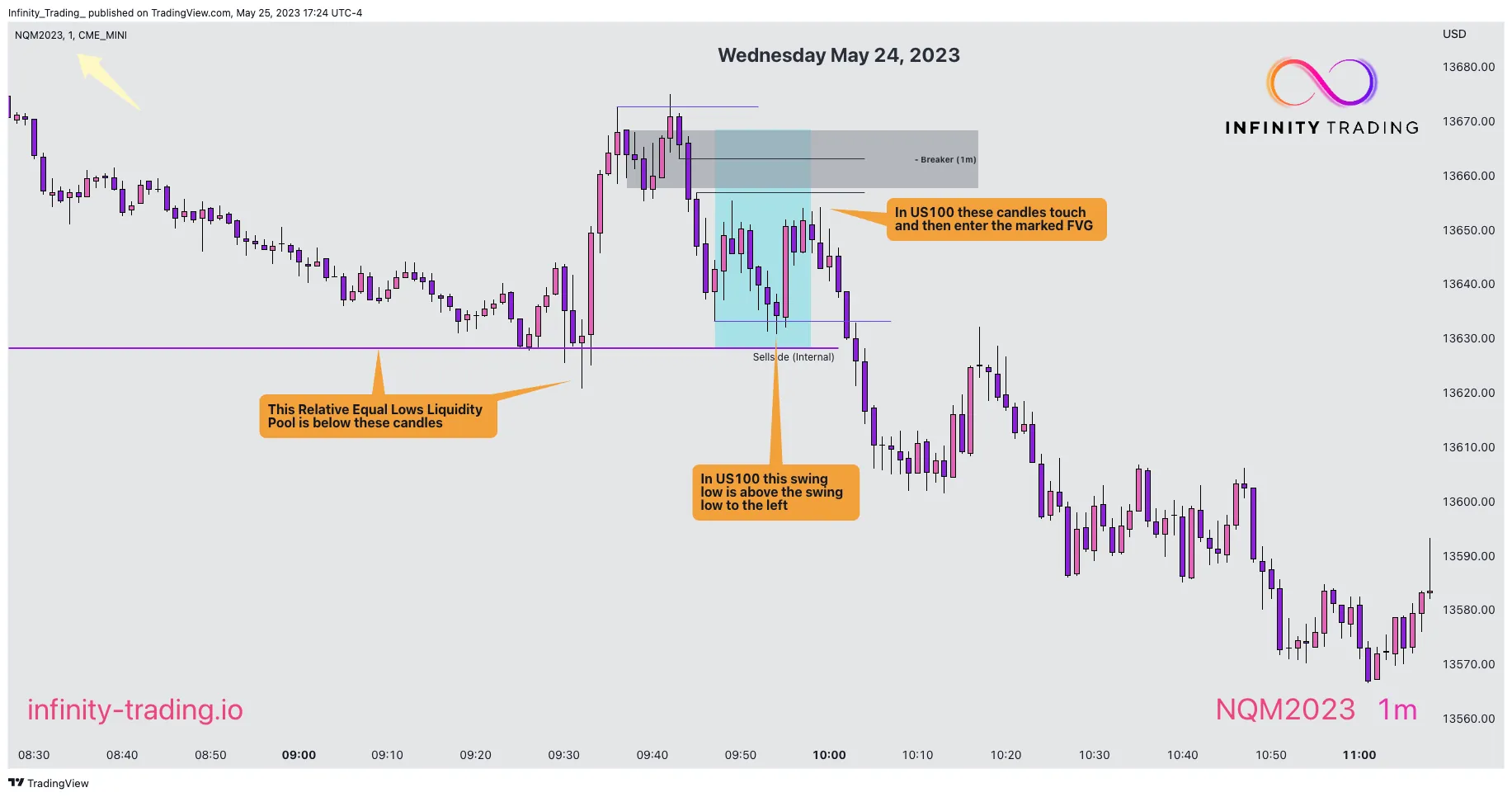

Compare the 1-minute candles from US100 above with the 1-minute candles from the image below of the same price action from NQ.

Notice the differences between US100 and NQ. Overall, the candles are doing the same thing, but there are important differences.

Hydra’s entire trade idea hinges around price returning to the Fair Value Gap (FVG) inside the Bearish Break (-BB).

But on NQ price never entered the Fair Value Gap (FVG) nor the Bearish Breaker.

Additionally, there are two other key differences in price action that can be clearly identified.

Futures US100 Verses NQ

Source:

🟢ICT Silver Bullet also worked with Breaker today..

— HYDRA (@Hydra_Thahmid) May 24, 2023

Amazing combination TBH :) pic.twitter.com/R5PsaGxVzy

Conclusion

Again if a trader can trade CFDs and likes them, then that is a great option. But for me I want to trade the real Futures financial product. So I will stick to Prop Trading Firms that only offer CME Futures symbols.