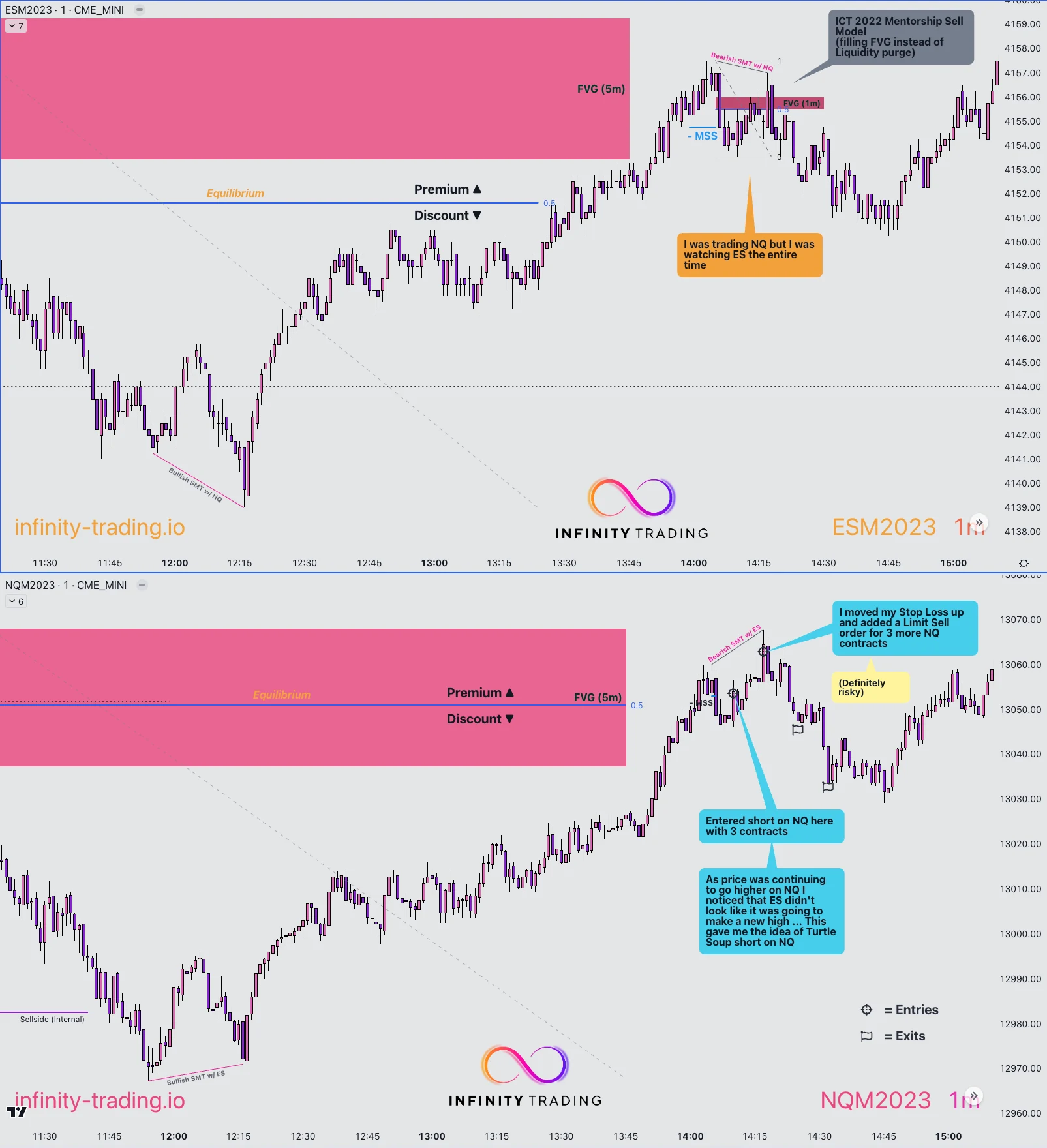

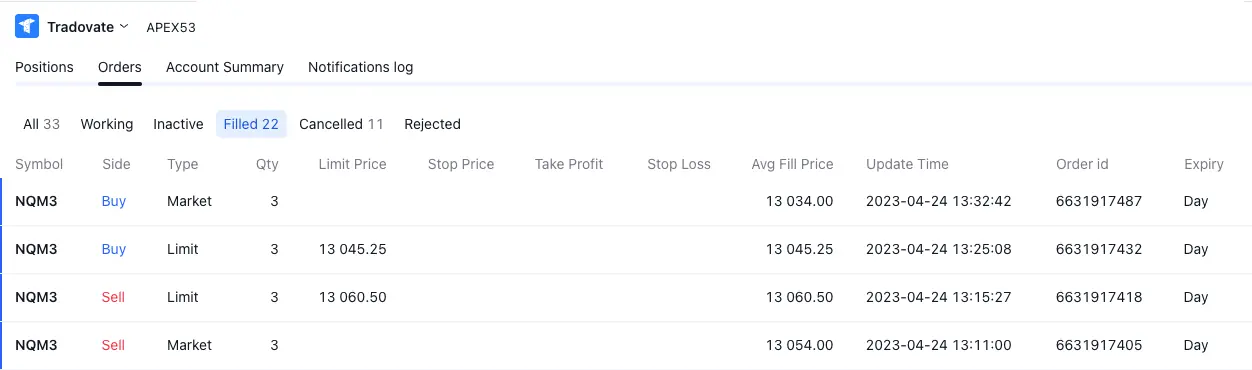

Monday, April 24, 2023

At noon ES & NQ had reversed and started going back up. I marked Equilibrium and started marking higher timeframe Fair Value Gaps (FVGs) in a Premium. I didn’t think price would make another new high today because it had already taken buyside and sellside. After ES & NQ crossed Equilibrium I started looking for Market Structure Shifts (MSS) that lined up with Displacement down. On NQ around 14:15 I found price action I liked and I went short with 3 contracts. Then price started climbing higher. So I immediately looked at ES and yes it was going higher, but it didn’t look like it would make a new high. While NQ looked like it would make a new high. (It is difficult to articulate for you why I thought that but with experience you can many times compare Correlated Assets you can observe one Asset is farther down/up than the other.)

This is when the Turtle Soup trade idea formed in my mind. So I moved my Stop Loss up and added a Limit Sell order on NQ above its highs. NQ traded higher and hit my Limit order. NQ actually went up much higher than I expected but my Stop Loss was higher still. ES never made a new high so this was Bearish SMT Divergence. I was watching ES the entire time while trading NQ. When ES didn’t make a new high I knew the bearish reversal was extremely likely.

I exited 3 contracts when NQ went below the swing low where I originally entered at. I then exited my last 3 NQ contracts after another leg down.

Turtle Soup Trade on NQ

This was my biggest trade ever!!!

What I did was extremely risky

I would also like to acknowledge that would I did was extremely risky. If I had been wrong on my Turtle Soup entry I would have blown my account. Especially with doubling my contract size. But I was extremely confident after seeing ES fail to make a new high. Plus I had seen this exact scenario play out multiple times before. And the thing that provided the most value was understanding what price action was doing throughout the day. The NY Open started in a Premium and then proceeded to take out Sellside Liquidity. My trade short was in a Premium inside a higher timeframe FVG after price had been going up since noon. Always keep the macro movements in mind when taking a trade.