Friday, April 14, 2023

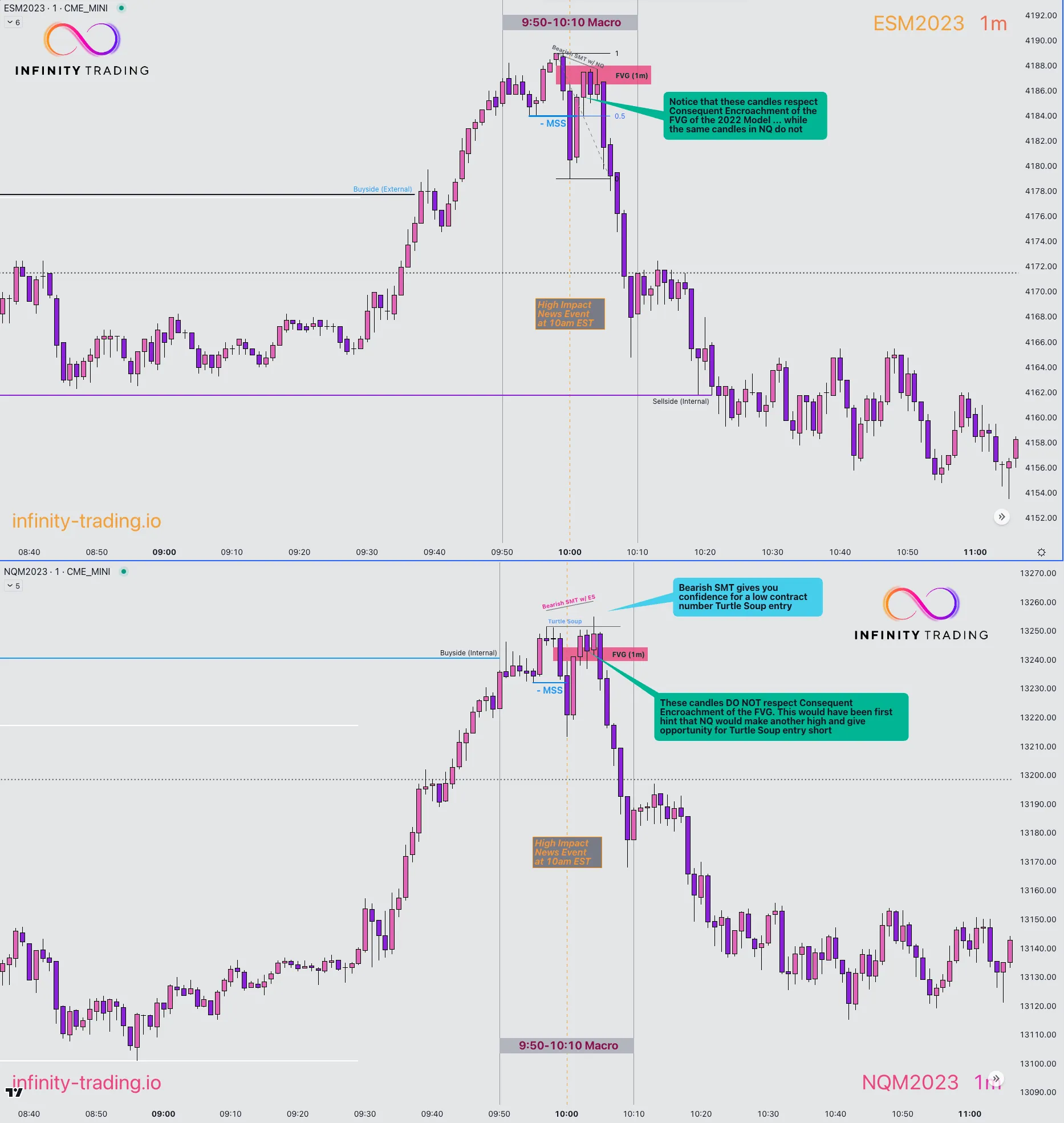

This is the ultimate endpoint I want to get to as a trader: to identify in realtime between Correlated Assets which one is likely to have the 2022 Mentorship Model setup and which is likely to develop the Turtle Soup Setup. And be able to trade both simultaneously!

In this example the Asset that respected Consequent Encroachment of the FVG (ES) became the 2022 Mentorship Model, while the other Asset (NQ) blew through the FVG and later was the Tutle Soup. I will need to do more backtesting to see if this hold true over time. But ICT has talked before on his Livestreams about looking at how price reacts to the FVG to determine what price is likely to do next.

A good starting point for simultaneously trading the 2022 Mentorship Model and Turtle Soup would be to start with 1 contact on the Tutle Soup setup and each successful trade add 1 contract.

It will take considerable effort to manage trading two assets at once, which is why starting with one contracts will be very beneficial and will help to reduce stress. For a Stop Loss on a Turtle Soup I think I will have to set a fixed amount of points I am willing to lose and just submit to it.