Wednesday, April 12, 2023

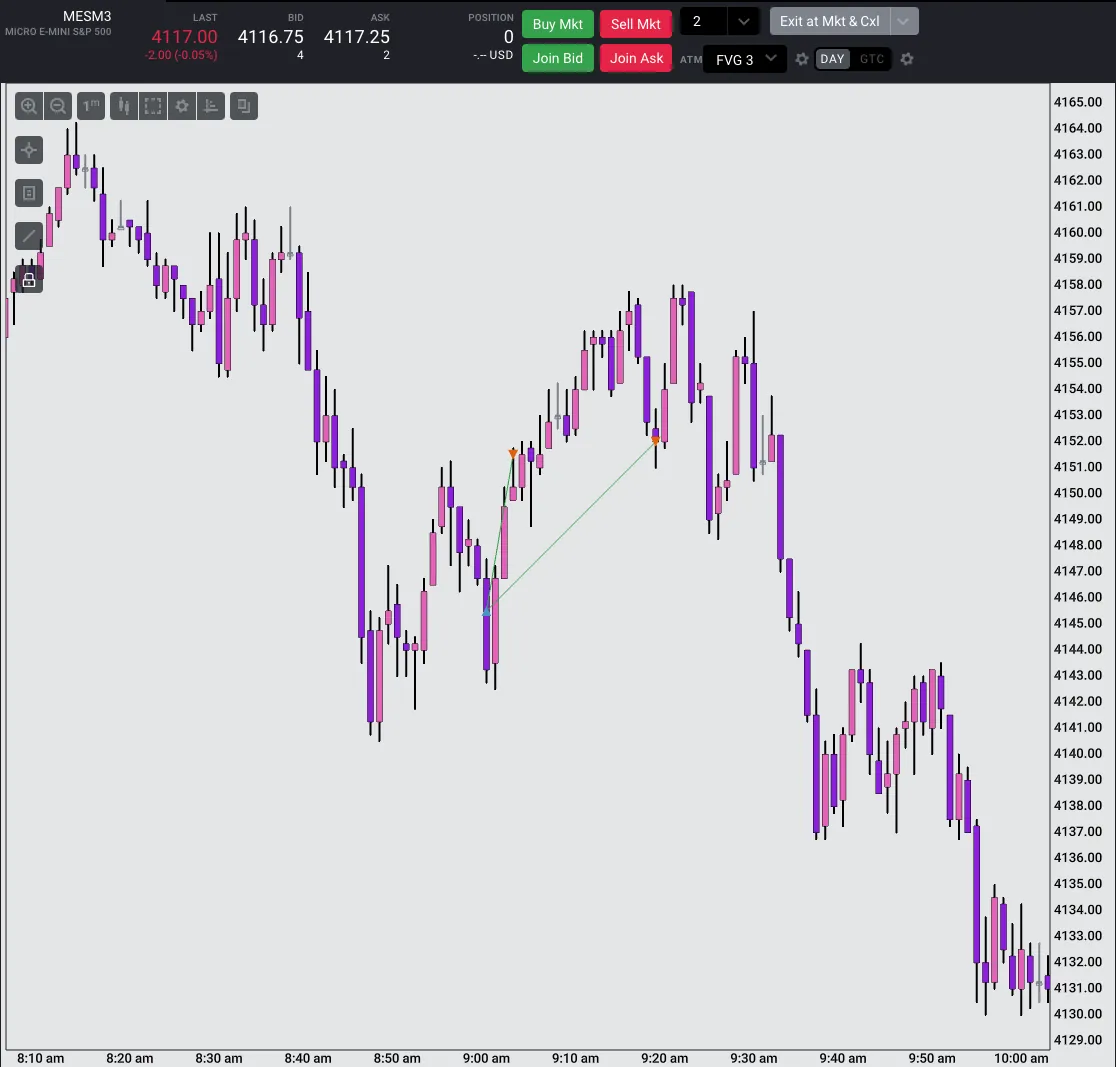

I was watching NQ fill in the CPI candle and then noticed NQ made a new low of the day while ES failed to go below the CPI swing low. This is Bullish SMT divergence. And as soon as I spotted a Bullish Market Structure Shift I knew the bullish move was a lock and I could safely trade ES while using the Liquidity purge requirement (of the 2022 Mentorship Model) from NQ. ES had a nice 2022 Model setup and I entered long with 2 MES contracts.

I took first profit after ES made a new high. I expected price to continue going higher to take out internal Buyside Liquidity. But then it abruptly reversed down and never took the Buyside. I closed my last position for profit. So overall very happy on CPI & FOMC minutes day.

Trade Recap

But upon inspection afterwards I failed to notice the double Bearish SMT divergence with YM AND I failed to take into account that ES had filled its Opening Range Gap (ORG) for that day. The price algorithm didn’t need to go any higher and it reversed. If I would have noticed these facts I could have been looking for short setups. Because I also missed a Hybrid 2022 Mentorship Sell Model that moved down quickly. I could have used the Bearish SMT divergence from YM as the reason for a Reversal lower instead of the usual Buyside Liquidity purge. But I missed all of this and price move quickly.

I am happy I made a good trade and executed mostly well. But this goes to show that trading requires paying attention to many small details in order to maximize trading opportunities.