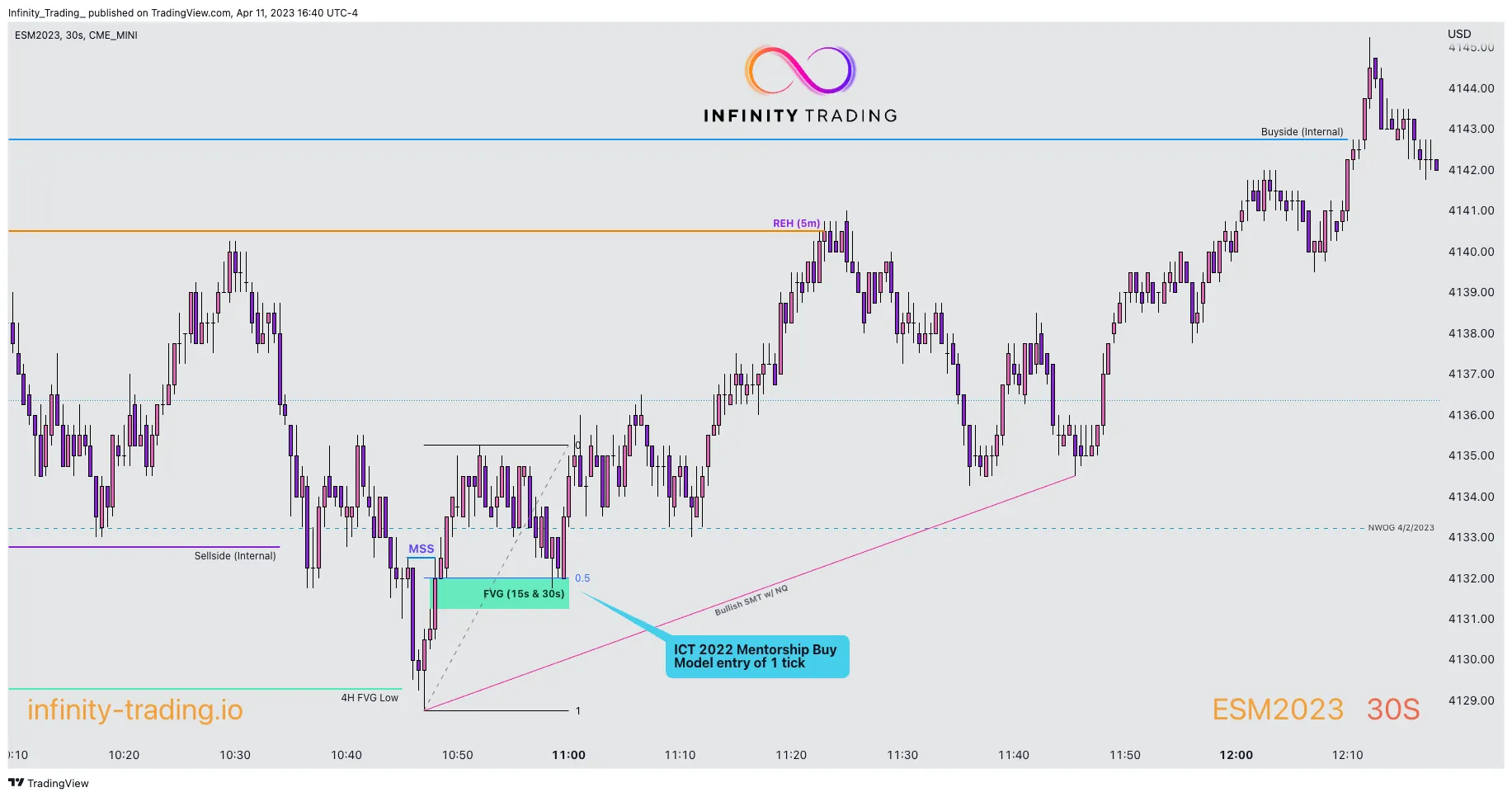

Tuesday, April 11, 2023

Today in the NY AM Session I was watching price action on the 1-min and ES had taken Sellside Liquidity and filled the 4-Hour FVG and then started going higher. But there was no swing high candle to create a MSS anywhere close to the FVG created by the displacement up.

There was no swing high candle to create a MSS anywhere close

So I decided to look at the 30-sec & 15-sec charts and then everything became clear! In fact there was a MSS but it was only on the second charts. There was a nice FVG with Displacement in a Discount. Price came into that FVG for 1 tick and that was enough for the Market Makers and price went up for the rest of day until 15:20 pm EST.

No MSS on the 1-min chart

So the lesson is to be nimble when searching for Reversals and the 2022 Mentorship Model. Sometimes these setups only form on specific timeframes.

ICTs 2022 Mentorship Model Criteria

- Price trades through major Buyside or Sellside Liquidity (Asian High/Low, London High/Low, Previous Day(s) High/Low, etc.)

- Price reverses direction and creates a Fair Value Gap (FVG) with Displacement (Displacement must exist. This signifies there is Institutional sponsorship to the move)

- A Swing (high or low) must be exactly horizontal to one of the three candles in the FVG. This swing is now a Market Structure Shift (MSS)

- The Swing High/Low can occur either before the liquidity grab or afterwards. Either way is valid

- Draw a 50% Fibonacci line (two options):

- Start at swing that took liquidity to a swing on the other side of the FVG

- Start at a prominent swing after liquidity taken swing to a swing on the other side of the FVG

- The gap in the FVG candles must be on the Equilibrium line (50%) or on the side of the Liquidity (i.e. the better side)

- Place Limit Order inside the FVG at the Equilibrium or on the better side of Equilibrium

- If SMT Divergence is observed in direction of MSS, then this is extra confirmation