Impulse Price Swings & Market Protraction

Video 8/8

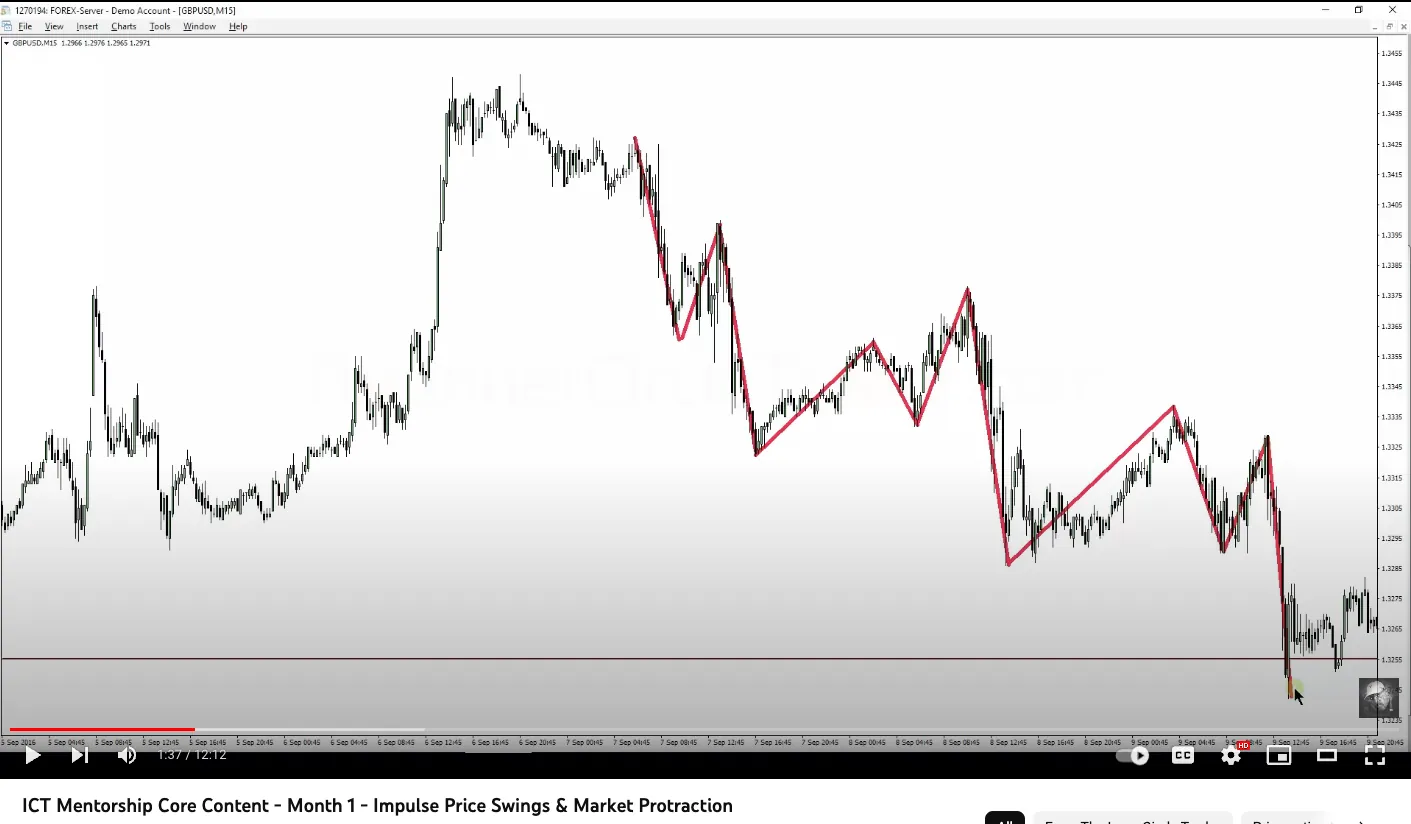

Impulse Price Swings

- Impulse Price Swings = obvious price swings you can easily identify on your chart

- When you look at price action candles you need to be thinking of impulse price swings

- In the image below the red lines are the Impulse Price Swings

- They are very easy to identify

- See the red lines ICT drew in his video in the image below

Impluse Price Swing Examples

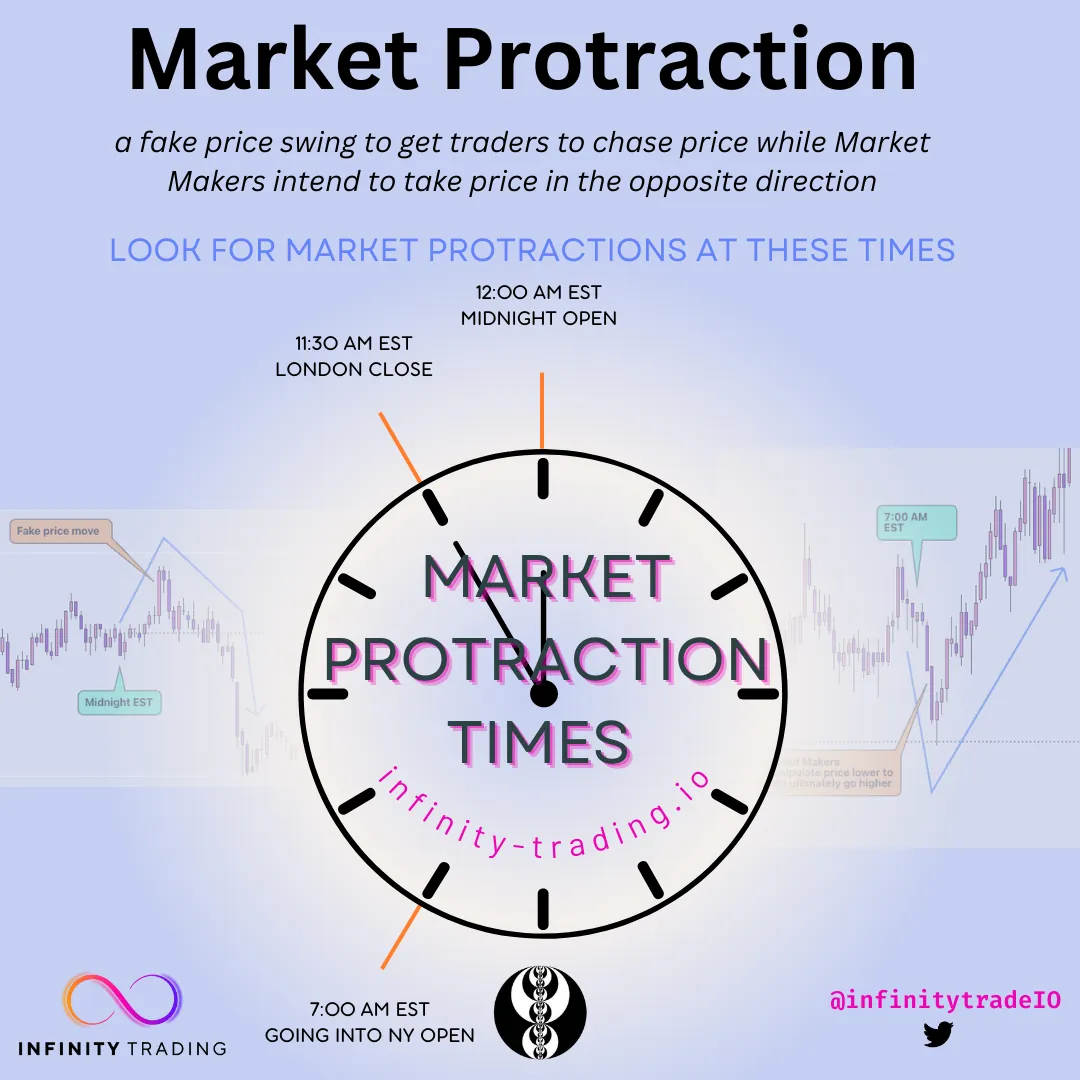

Market Protractions

- Market Protractions are a type/classification of Impulse Price Swings

- Market Protractions = an Impulse Price Swing that is highly sensitive to the time of the day

- The Market Protractions’ entire purpose is to manipulate or trick retail traders

- Market Protractions are caused by the Market Makers

- Market Protraction characteristics:

- The Market Protraction takes the form of a small price swing

- That is counter to the major market direction at the time they occur

- A Market Protraction is a fake price swing to get traders thinking the price is going in one direction, while Market Makers intend to take the price in the opposite direction

- To get traders to chase the initial price move

- The purpose of Market Protractions is to generate liquidity intraday. Retail traders find themselves on the wrong side of the price (in these fake price moves) and they must exit their positions. The Market Makers are there taking those positions to further propel price in the direction they intend

Market Protraction Visualization

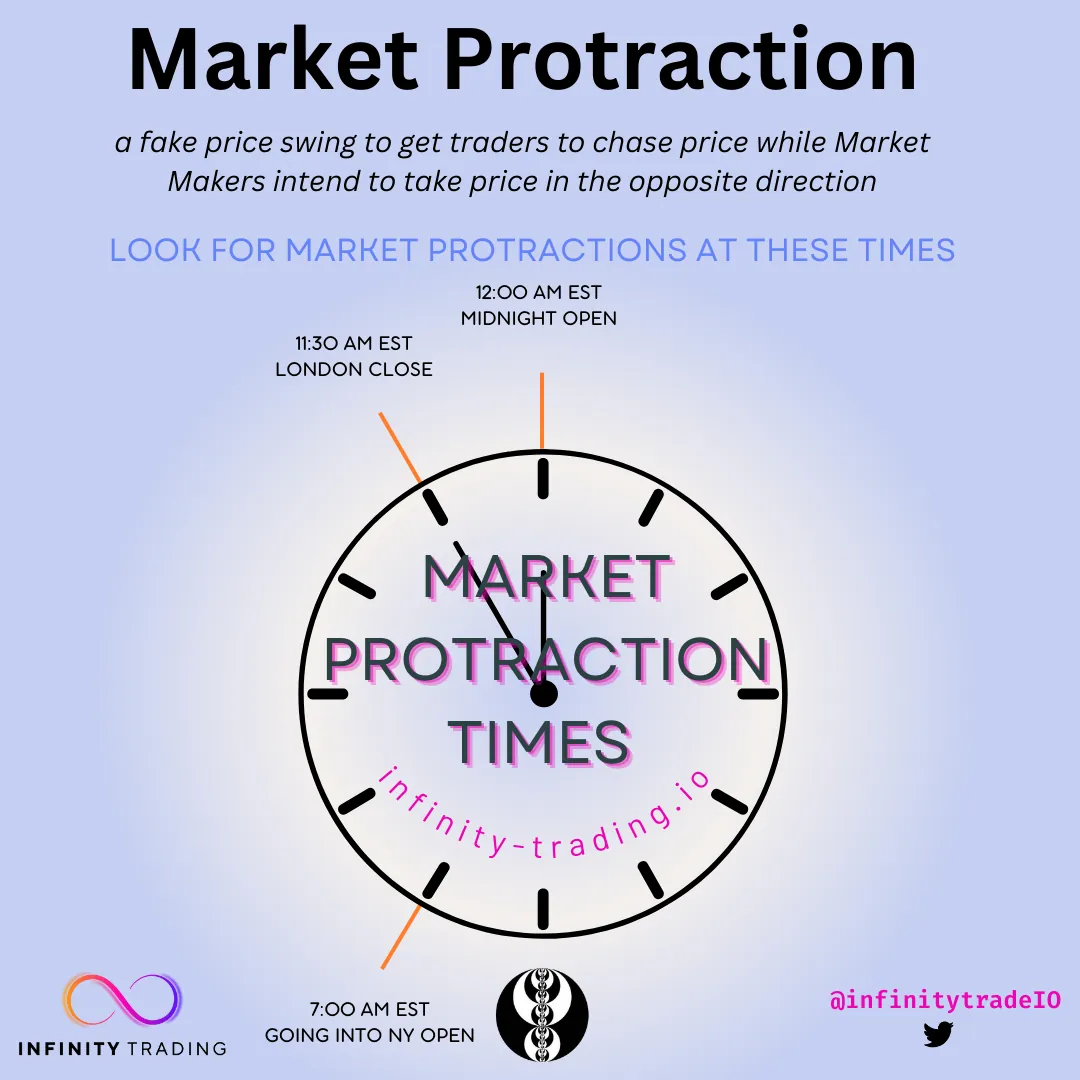

Market Protraction Times

- But the GOOD NEWS about Market Protractions is that they occur at very specific times of the trading day!!

- There are 3 primary protraction market moves every 24 hours

- Midnight EST

- An impulse price swing forms at midnight EST and its design is to fake out individuals to get them to chase the initial move at midnight

- 7 AM EST

- Going into NY Open

- This move is intended to get traders to think that the market is reversing

- 11:30 am EST

- London Close

- Look for reversals around this time

- Midnight EST

Market Protraction Visualization

Trading Market Protractions

- The Market Protraction seeks to draw in participants on the wrong side of the marketplace

- Market Protractions are manipulation. It is counter directional

- If the price moves in one direction after the Market Protraction hours we think the opposite direction

- If the price goes lower at Market Protraction time then expect it to go higher

- If the market goes higher after Market Protraction then anticipate it going lower

Example